🎆 Intro

The purpose of this post is to explore the transportation industry trends in 2023, including the mobility industry as a subsegment of the industry as a whole. I hope this post will offer product managers, tech leads, and startup owners and operators valuable resources for developing product and business strategies for 2023 or identifying business opportunities within the sector.

☑️ Post Objectives: This post aims to review market research to better understand the economic dynamics of the transport industry. In addition, we will discuss COVID-19’s impact on the industry, transportation policy, deep tech, and innovation, and conclude with an analysis of two key products, Tesla’s Semi truck, and Rivian-Amazon medium-range electric delivery van, both of which represent a significant shift in the transportation sector.

🏷️ Tags:

Transportation ; Logistics ; Freight ; Aviation ; Electrification ; Mobility ; Tesla-Semi ; Amazon-Rivian ; Transportation Policy ; Hybridization ; Infrastructure

📋 Table-Of-Contents

📈 Key Metrics Covered:

[1] CAGR [2] Competitive Landscape [3] Market Size [4] New Product Launches [5] Growth Strategies [6] Revenue Analysis [7] GDP

🌄 Problem Statement

Globally, the transportation industry represents a significant part of the global economy, accounting for approximately [7] ~ 8.4% of world GDP in 2021 which we’ll be unpacking in the next section, covering market research, and like waves in a sea, the industry is constantly shifting, and with some of the looming concerns surrounding the world economy in 2023, product teams will have an even greater responsibility to plan appropriately in the future.

The transportation sector and the transportation industry can be divided into four distinct subsectors: air, rail, road, and water, and further broken down into more distinct sub-industries: Mobility, shared-mobility, air freight and logistics, airlines, marine, railroads, trucking, airport services, highways, rail tracks, marine ports, and services all of which make up the transportation sector and transportation industry buckets.

🏛️ Transportation Industry Market Research | Mobility & Shared-Mobility Market Research | Air Freight & Logistics Market Research

Based on 12-23-2022 data, the Transportation industry has declined by [3]~ 2.0%, primarily due to Union Pacific’s decline of ~ 1.8%. Year-to-date, the industry has declined by ~ 25%. Over the next few years, analysts expect earnings to grow by ~ 14% annually. Within this sector, North America will continue to be the largest market, while Asia Pacific will be the fastest-growing.

Across all geographical regions, the Transportation industry and its subsectors will grow at a [1] CAGR of~ 5.8%. In most regions, the transportation industry and mobility industries contribute significant amounts to net global GDP, employment, and targeted areas of innovation. Depending on the region, investment and business opportunities will vary greatly.

By 2023, the global market is expected to double in size as a result of shifts in market demand and the growth of emerging markets. The total market size is estimated to reach [3] ~ $8.3 trillion USD, with the logistics segment accounting for the largest share of the overall transportation market and its subsectors.

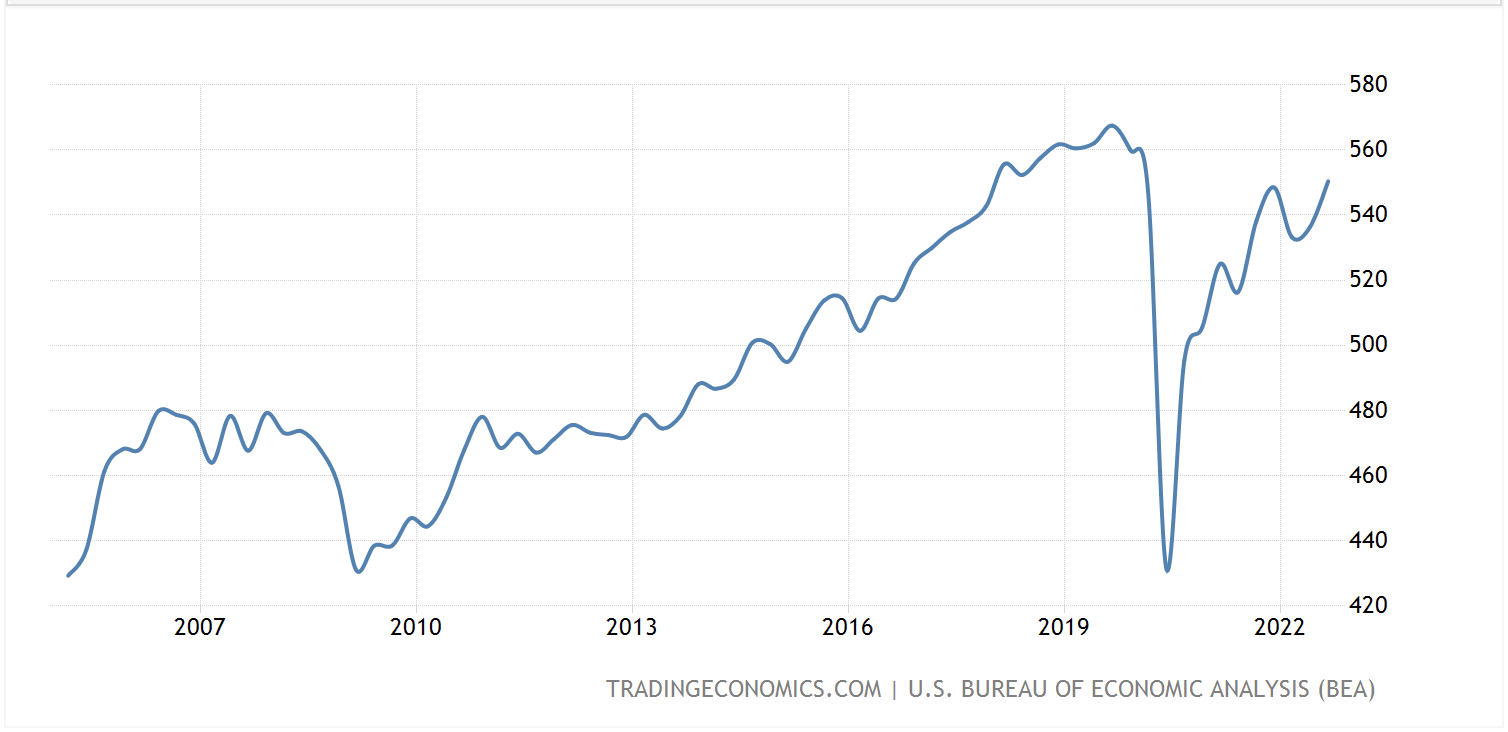

[7] During the third quarter of 2022, the United States GDP from transport increased from ~ $536.40 Billion USD to $550.40 Billion USD :

source: TradingEconomics.com

According to the National Transportation Institute, the transportation industry is expected to generate [6] ~ $1.5 trillion USD in revenue, an increase of ~ $300 billion USD from 2022, for the US market specifically.

The global public transportation market was valued at [3] $206.7 billion USD in 2021 and is expected to grow at a compound annual growth [1] (CAGR) rate of 5.9% from 2022 to 2028, according to a Grandview Research report.

🛴 Mobility & Shared-Mobility Industry’ Market Research

In 2022, the shared-mobility segment is forecast to grow by an average annual rate of [1] ~ 8.73% (CAGR 2022-2027) to reach a market size of ~ $1.8 trillion USD (this is not in addition to the total market size already mentioned). Statistical data on this topic can be further examined by reviewing a report published by Statista covering the shared-mobility segment.

The global mobility segment is expected to represent more than half of the total transportation market over the next five years, with the automotive and automotive aftermarket segments representing more than half of the market share of the global transportation industry.

“According to the United Nations data, around 55% of the world’s population lived in urban areas in 2018, and according to the projections, the figure is expected to reach 60% by 2030”.

Due to the increasing number of people living in urban areas, and commuting to and from work, the traditional transportation sector, as well as many of its subsectors, will continue to be distributed. As a result of the pandemic, the bicycle industry was able to reactivate millions around the world, myself included, a trend that peaked in 2021 but will hopefully lead to more and more people choosing to commute to work via bicycle. A bike commute falls under the micro-mobility segment of the shared mobility bucket, and the National Transportation Institute reports that this segment will grow to [3] ~ $1.8 trillion dollars by 2030, as we reviewed earlier in this post.

📦 Air Freight & Logistics Market Research

The Air freight and logistics market is expected to grow at a [1] (CAGR) of 4%, reaching [3] $21.13 Billion USD by 2030 for the US market specifically, during the forecasted period between 2022-2030. This data is referenced from a comprehensive report published Market Research Future.

📉 Mitigating Transportation Industry Inflation & Economic Downturn Risks

In order to mitigate inflation risks in 2023 for the transportation industry, companies operating in this industry, as well as in most industries, must conduct pricing analyses in order to maintain rates in line with inflation. Bloomberg’s analysis published on 12-01-2022 indicates that this will be particularly crucial to the trucking industry, distinctively for equipment, maintenance, and labor. Additionally, freight rates and capacity are expected to decrease in 2023 due to the overall rate cycle and economic downturn, or correction.

🩻 Transportation COVID-19 Impact

COVID-19 and the subsequent economic downturn have negatively or adversely affected the transportation industry as a whole, as well as each sub-industry and segment within it. Still, some analysts and economists are now predicting a soft landing rather than a major economic downturn that will result in milder unemployment claims and economic contraction.

There are still some demand and supply-side shocks making their way through the transportation industry, especially in the air and freight segment, causing some to worry about further contractions in 2023.

Across the entire transportation industry – As the pandemic took hold, there was a critical shift within the industry, with a greater focus on providing the world’s citizens with emergency transportation, as well as ensuring that a skeleton workforce was available for essential workers and for freight transportation to continue, primarily.

There was a ripple effect on the entire transportation industry between 2020-2022 due to the looming fear of contracting or spreading the virus, and until a majority of the nation was either completely vaccinated, or confident that they would not contract a severe illness, this trend has almost entirely shifted. However, with the recent numbers coming out of China, some fear we’re not in the clear yet, especially for those who declined the vaccine.

As a result of the epidemic, mass transportation all but ceased, except for essential workers, with highways, trains, buses, subways, and taxis reducing capacity by almost 100% at times.

Travel restrictions existed in most geographical regions throughout 2020 and into 2022, with some regions still experiencing restrictions on travel among many travel segments, or being outright banned until relatively recently, and from regions in China, where forced quarantine upon arrival was only lifted as recently as 12-2022.

During the pandemic, air travel all but ceased, but demand for travel in certain segments skyrocketed as more and more people chose to explore the outdoors. Air travel numbers in 2022 have exceeded pre-pandemic numbers, again, some experts believe we are seeing a new normal as part of a macro-event some call the great reset, or the great unraveling - More will surely be revealed in the months to come….

Transportation Industry & COVID-19, Shifting Consumer Behavior

E-commerce and online shopping took off during the pandemic, forcing logistics companies to adjust to meet consumers’ changing demands. Efforts have been made by FedEx to assist small businesses in adapting to the new environment, while DHL and UPS have introduced new services to support the e-commerce industry. In addition to delivering packages faster and more efficiently, these new services will make the delivery process more accessible and more reliable for consumers well after the pandemic has waned.

During India’s lockdown, the government introduced a new delivery service called Kisan Rath App, for the transportation of farm produce from farms to markets. More than 500,000 vehicles and 20,000 tractors were deployed to support this new service, which rapidly found product market fit and continues to expand its reach.

Some of the other trends worth calling out that are either a direct or indirect result of the pandemic include a massive driver shortage, available semi-truck, and tractor drivers, and increased cost of goods and services due to supply chain bottlenecks, which further perpetuated inflation. The commercial freight and logistics sector has also been experiencing a massive shortage of available pilots, again, putting further pressure on an already fragile economy.

⚖️ 2023 Transportation Industry Policy Analysis

The US Department of Transportation (DOT) is focusing its efforts in 2023 on safety, economic strength, global competitiveness, equity, climate and sustainability, and transformation.

By doubling the number of R&D projects focused on breakthrough discoveries introducing new technologies or approaches not used in the transportation industry currently, the program aims to match research and policy to advance breakthroughs in the transportation industry.

Transportation Policy Initiative Call-out:

“The U.S. Department of Transportation’s ITS research focuses on several high-priority areas including Emerging and Enabling Technologies, Data Access and Exchanges, ITS Cybersecurity Research, Automation, ITS4US, and Accelerating ITS Deployment. The ITS Strategic Plan includes an in-depth discussion of the ITS Program’s strategic goals, these research areas, and four technology transfer programs”.

During FY 2022, the US Department of Transportation passed the Bipartisan Infrastructure and Investment and Jobs Act (IIJA), the Bipartisan Infrastructure Law, which promotes improved transportation networks, reduced congestion, improved safety, and enhanced infrastructure resilience.

A once-in-a-generation investment in the nation’s transportation infrastructure will create jobs and repair old, unattended infrastructure that has been in disrepair across the nation for years, and with varying degrees of fragility exposed to different regions.

Transportation Policy Initiative Call-out:

The FY 2022-26 U.S. DOT Strategic Plan, which, The Fiscal Year 2022-2026 Strategic Plan establishes the U.S. Department of Transportation’s strategic goals and objectives. This is a roadmap for transformative investments that will modernize our infrastructure to deliver safer, cleaner, and more equitable transportation systems.

Policymakers around the world are urging improvements to roads, bridges, airports, and other infrastructure that facilitates commerce.

Additionally, some of the other policy initiatives in the US include the Build America Bureau, which aims to “Finance Infrastructure to Move America Forward”, as well as the FAA Reauthorization Act of 2018, which modernizes the FAA, increases the safety and speed of unmanned aircraft systems, and improves airport infrastructure.

In addition, the Consolidation Appropriations Act of 2021 establishes new safety standards for oil, gas, and hazardous liquid pipelines across the nation.

🚝 2023 Transportation Industry Trends & Innovations

🛫 Transportation Industry Business Strategy, Trends & Innovation…

As autonomous driving and advanced mobility systems become more prevalent in 2023, the transportation industry and sector including each of the sub-segments and mobility sub-industries will present a few key business opportunities for companies attempting to enter the space or for existing companies attempting to ship innovative new solutions to pre-existing problems within the transportation industry. Identifying these opportunities can be challenging, so how do we do it?

With [5] competitive and comparative analysis, we are able to identify opportunities and position our products to capture market share from existing competitors. In order to ensure that our products are competitive in the market, we analyze the key innovations, deep technologies, pricing strategies of our competitors, and new business models of our competitors, etc. In the context of our competitive analysis and comparative analysis.

Next, let’s examine the innovations currently taking place within the industry as a strategic advantage and two 2023 Transportation Industry Product Innovations that will impact the industry.

🚊 2023 Transportation Industry Trends & Innovations, Continued…

The transportation industry, including demand-mobility, has relied heavily on innovation to succeed. A number of advanced technologies are being invested in by companies today, such as autonomous vehicles, electrification, hybridization, artificial intelligence (AI), and machine learning (ML), among others, which we will discuss in this section of this post.

As a consequence of these investments in technology, [5] companies are able to offer innovative new services, improve customer satisfaction (measured as CSAT), reduce unit economic costs, (such as cost per trip completed in the transportation industry,) and gain a competitive edge, among many other desired outcomes and optimizations to both business and customer problems.

Lastly, new business models are emerging in the space, such as Mobility as a Service (MaaS) and Mobility as a Platform (MaaP). The base case for success in a modern business climate can be considered research and development as a means of controlling long-term outcomes. In spite of the current economic climate, businesses in the transportation industry and sub-sector can gain a competitive edge and capture market share through innovation in and of itself.

🔬 Deep Tech & The Transportation Industry | AI | ML | Automation | Autonomous Driving | Electrification | Drone-Delivery | Blochchain-Fleet-Management

There are several key factors to consider, including the introduction of electromobility, and the drive by automakers to produce low-emission vehicles using renewable resources like hydrogen, hybrid ICE platforms, and biofuels. Trucking is being electrified, which we’ll be reviewing in the next section, and more and more people are becoming activated to electric bicycles and electric scooters within the mico-mobility segment. Which are being leveraged more and more for short-range transportation within the city and urban centers, primarily.

A number of SaaS companies operating in the transportation industry are using AI and machine learning (ML) as part of their core business logic and strategic advantage to solve problems such as transportation management SaaS, fleet-management SaaS, route optimization, utilization, and planning optimization.

A variety of innovative rail systems are being proposed and developed to transport people to and from central business and commerce hubs, as well as infrastructure initiatives and policies in North America, Europe, Asia-Pacific, and Africa, which we reviewed in this post’s market research sub-section, transportation industry policy analysis 2023. The aggregate of our railways, roadways, and transportation infrastructure dates back over 50 years, so both of these issues are ripe for innovation.

As retailers and transportation companies focus on last-mile delivery, some companies are already using drones to deliver packages. Amazon delivered its first drone-delivered order to a customer at the end of 2016. As part of Amazon’s new Prime Air program, this delivery was made to a customer in England within ~ 30 minutes.

As a result of Amazon’s successful completion of this test run which was technically part of their alpha-testing program, numerous companies have invested in drone delivery to improve their business and customer experience, a trend that is expected to accelerate in 2023 as the last-mile trend continues.

Furthermore, the adoption of different technologies such as cellular (5G), along with the post-industrial theme, have created the Internet of Things (IoT), a concept that represents a world where more and more of what we interact with is networked, and therefore can be used in concert with one another, often to optimize. Also, blockchain solutions (DLT) will improve authenticity, and efficiency, reduce costs and optimize safety. As a result of these innovations, transportation companies will also be able to provide better customer service and increase customer satisfaction (measured as CSAT).

Ultimately, the transportation industry is expected to experience enormous growth in the next few years, thanks to the introduction and application of new technologies, as well as the development of innovative solutions for existing or legacy problems. Let’s take a moment to review the newest transportation industry product innovations, including the Tesla-Semitruck and Rivian-Amazon, a fully electric delivery van.

🚍 2023 Transportation Industry Product Innovations

**Rather than reviewing products as an industry aggregate, I decided I would review two products that represent two of the more impactful changes to the transportation industry as a whole in the coming years, each of which will force evolutionary change to the industry as a whole, a complete step change from the traditional models they’re positioned to disrupt.

Automated and electrified trucking and logistics sectors, as well as the use of autonomous engineering to increase safety, remove human drivers, and improve efficiency. In the case of Tesla, these new innovations will allow the company to further integrate vertically within its organization, among many other improvements.

🚚 Rivian-Amazon | 🚛 Tesla Semi-truck

There will be two major problems facing the transportation industry in 2023 centered around both a lack of available truck drivers and a shortage of semi-trucks. These two themes are said to be the industry’s top concerns in 2023 as a whole, and both companies in this section are solving this problem, with technology that is orders of magnitude more innovative than legacy semi-trucks.

The two players worth tracking closely to gauge overall growth in this space are both [4] Tesla and Amazon. In 2023, it is expected that Tesla will open up reservations for their autonomous semi-truck, which was recently showcased by demonstrating that the truck could travel ~ 500 miles on a single charge with a full load of cargo onboard. This represents a major milestone for the industry and will make the transportation of goods and services much more efficient. As of 12-2-2022, the first unit has been delivered, but there are no other statistics regarding production levels or pricing.

Through their strategic partnership, [4] Amazon and Rivian are revolutionizing the way goods are transported, with Amazon increasingly acquiring shares of Rivian as they position their fleet to incorporate more and more electric vehicles into the future. Rivian Amazon delivery vans are zero-emission vehicles designed specifically for the Amazon delivery use case.

With over ~ 1,000 units already in its electric fleet, the company is on track to managing ~ 100,000 zero-emission vehicles by 2030. This is a major milestone for the transportation industry, making the transportation of goods and services much more efficient.

Among other optimizations, Rivian’s battery technology continues to be heavily invested in, aiming to improve range, reduce charging time, and improve overall efficiency. With a full load of cargo or people, the new battery pack can travel up to 500 miles on a single charge thanks to its high nickel and lithium iron phosphate (LFP) chemicals. Through their commercial vehicles, the Rivian Amazon, as well as their consumer products (R1S & R1T), the Rivian Amazon can transport people and goods over medium and long distances, a key value proposition for the company’s mission of improving transportation in the years to come.

LFP batteries do not require nickel or cobalt, which can be expensive or difficult to obtain. Compared to Tesla’s nickel cobalt aluminum oxide cells, they are also generally considered more stable, but less energy dense.

The final product I will call out as part of this section is the [4] Tesla-semi which represents a step change in technology over traditional semi trucks, as we reviewed in the opening statements of this section - This machine is more evolutionary than the media seem to be calling out, and represents the greatest change to the large-scale trucking industry since the introduction of ICE semi-trunks in the early 20th century.

Paired with the most capable and sophisticated autonomous systems, drivers will now become analysts, simply overseeing that the machine is operating at optimal conditions. The Tesla semi-truck solves so many core challenges currently facing the industry, including driver shortages, fleet maintenance, driver safety, fuel consumption, and the list goes on and on.

Not to mention the vertical integration of the Tesla battery technology and production is truly game-changing for the industry, in addition to being the most advanced and the most efficient on the market, the identified efficiencies we see now will lead to more units on the road long-term.

Tesla-semi will also become the first commercial, large-scale application of blockchain technology in the transportation industry, which will allow for a new wave of flexibility in fleet management, as well as the ability to track and trace the history of each and every vehicle and its components, as well as the ability to implement any number of smart contracts within the blockchain.

Therefore, increasing transparency over the entire delivery cycle from the factory to the customer, as well as enabling point-to-point tracking of goods and services. As opposed to a single source of data managed in a database by one entity using double-entry accounting, which reduces transparency and traceability. Using a triple-entry accounting system is the key value proposition of blockchain in the logistics and transportation industries.

🌍 🎖️ Conclusion

For those interested, and would like to explore investing in the future of the transportation sector, transportation sector ETFs, are an excellent option for those interested in exposing their portfolios to the potential growth of the transportation sector in 2023. For those interested, this resource can be used to learn more about the transportation sector ETFs. Check out this article covering 6 transportation ETFs by ETF.com. – Full transparency, this is not financial advice.

Stay tuned for my next post, where I will be presenting my case study for the 2023 Technology and Science and Engineering Industries, as well as a post, titled, How (AI) is changing Product Management. And lastly, a post titled Post-Industrial Banking, where I review some of the events that have forced us to rethink how we bank, from traditional brick-and-mortar to digital-first, perpetuated by the pandemic.

Thank you ya’ll, for taking the time to read through part 2 of my business trends report; 2023 Transportation Industry trends, covering trasnportation industry market research, US trasnportation policy, Transportation Industry Innovations, such as AI and autonomous engineering, and Transportation product innovations within the industry, including the Tesla Semi-Truck and Rivian-Amazon.

✰ To view the first post in the 2023 Business Trends Series, where I will cover one industry, sector, or theme per post, click this link 👉 🛢️2023 Energy Sector Forecast: Market Research, Innovations, and Business Opportunities. The series will continue through Q1 2023, possibly into early Q2.

👾 More Recent-Posts

-

Bitcoin (BTC) Revolution: Catalyst, History, and Analysis

The main goal of this piece is to gain a deeper understanding of the reasoning behind the creation of Bitcoin, allowing for a more comprehensive perspective on its future

-

Macro & Geopolotics Report: 2023 Business Trends Report

In this post, we discuss macroeconomics, as well as geopolitics as part of the 2023 Business Trends Report 🌍

-

💲NEAR Protocol: Overview and Price Prediction

In this article, we will be conducting an extensive analysis of the 💲NEAR protocol, which is the platform I have the most experience building dApps on, as a Product Manager in web3

-

8 Healthcare Industry Trends and Innovations

In this post, we will be reviewing 8 business trends for the healthcare industry, including each of it's sub-industries, such as MedTech🔬

-

Cardano(ADA) Overview and Price Prediction

As a part of this post, we'll be reviewing what Cardano (ADA) is, its benefits, Tokenomics, a price prediction model, and the future of its fledgling ecosystem 💱

-

Ruby on Rails and The Future Of MVC

Discover the amazing potential of Ruby on Rails! Learn about its history and design philosophy, why it's the perfect choice for web development, and how to get started with the framework ♦️

-

Artificial Intelligence: Business Trends Report

Large language and generative models are reaching a point of emotional realness that they can no longer be distinguished from humans 🚀

-

2023 Geopolitics Report

A guide to help both businesses and product managers use geopolitics as a strategic advantage in 2023

-

Post-Industrial Digital Banking

Explore the post-industrial era of digital banking. Deployment-based market research, post-industrial hypothesis validation,opportunities,and more 📲

-

How 👾 (AI) Will Transform Product Management

In this post, we will unpack how (AI) will transform aspects of product management, as well as it's impact across cross-functinoal teams 🎖️

-

Energy Sector Forecast 2023 ⚡

The 2023 Business Trends Report covers sector-based projections, major innovations, market dynamics, opportunities, and technologies by sector or industry - this post covers both traditional and renewable energy markets 📈

-

To-Blog Or Not-To Blog❓ | 2023 Blog Launch Helper |

This post is designed to help you or your team launch and optimize a successful blog by examining why businesses blog, providing a blog business plan guide, exploring SEO and analytics tools, and an overview of blogging platforms and frameworks

-

Make the web fast again | What is a CDN❓| How do CDNs work❓

In this post, we review what a CDN is, how they work, the business of cdns, as well as some of the best options to consider when choosing a cdn

-

We're In Way Over Our Heads | Going Headless (CMS)

Content is king! In this post we review Headless-CMS, content management systems; How they work, an overview of JAMstack, some of the best options, etc, will be discuessed

-

Building Static Websites In An Un-Static-World (SSGs)

In this post we'll be reviewing (SSGs) static site generators, reviewing the tech as a means of providing value to your next project or business during times of uncertainty– The advantages, how they work, and evaluating frameworks, including Jekyll, Hugo, and Gatsby. JS, etc 🛠

-

How (AI) is changing the way we work

In this post, we'll explore two use cases for (AI) ⚔️ (AI) Writing and Text-To-Image (Generative-AI) – How they work, as well as their current and future, use cases for the workplace, as well as available tools and services

-

Industrial Revolutions

Part-1 (1-2 IR) This is the first post of the Industrial Revolution series, covering the 1st and 2nd Industrial Revolutions, major tech innovations and advancements during each period

-

Industrial Revolutions

Part-2 (3-4 IR) This is the second and final post of the Industrial Revolutions series, covering the 3rd and 4th Industrial Revolutions. Focusing on the tech and innovations during this period

-

Tokenomics

Ledgers and Accounting represent two foundational aspects of tokenomics and token-engineering, this is the first of many post where I will be covering tokenomics, focusing on presenting my research and aspects of system design

-

Fintech Deep-dive

How the tech industry is changing finance: This post outlines the history of financial technology (FinTech) and major innovations, as well as companies at the forefront of this sector

-

Web 3 Systemic Issues Report

In this post I review some of the most systemic-issues that I have identifed after contributing to a few web3 startups in varying levels of involvement – please take what is stated as speculative conjecture, nothing more 🙏