💥 Intro

When evaluating modern finance, you do not need to look very closely to see the relationship between finance and tech, and how each industry has played an integral role in the overall success of either sector. Some of the most impactful innovations during the 20th century were a direct result of finance and banking organizations using tech innovations as their strategic advantage over the competition.

In this post, I will be offering my opinion on the current state of the Fintech industry. I will be examining the history of financial technology, the major revolutions that led to the current state of the industry, and the economics around the industry. My focus will be on adoption as the success metric being evaluated, the engineering and companies innovating within the space, and the political dynamics and strategic advantages as a business case.

👾 Table Of Contents

🤔 What Is Fintech?

I am assuming that most of my readership is familiar with the Fintech industry; however, for any readers who are not, let’s first review what Fintech is on a high level.

‘Fintech’ is a portmanteau of the words finance and technology. The term refers to the growing number of companies disrupting the financial services industry, and covers a wide spectrum of technologies, from mobile payments and online banking to big data and decentralized ledger technologies or blockchain. What all of these technologies have in common is that they are collectively changing the way the world banks. What lies ahead for Fintech is still yet to be determined, but one thing is for certain – the industry is on track for significant growth in 2022 and the years following.

🌖 The Revolution

It is difficult for me to evaluate the internet’s impact on the world without holding multiple contradictory beliefs. Those same principles can also be applied to the finance and banking industry; at a later date, and within a parallel post, I will elaborate further on this point. However, I will keep my areas of focus more restricted in order to keep this article concise and devoid of any trailing thoughts– While technology has made information more accessible and available to anyone with an internet connection, it has also caused some fundamental issues in our society. More often than not, the founders and leaders of both finance and tech companies only measure the impact that their services and products have on society posthumously, and only after the harm has been done.

In considering the rate at which technology is evolving, it seems that we often overlook the relationship between technology and finance, and how both sectors have been at the forefront of innovation since the advent of our modern industrial system, a period during which the first industrial revolution started.

(For more information about the industrial revolutions, please view my post, The Industrial Revolutions (Part-1)).

Tech & Banking in the 19th & 20th Centuries

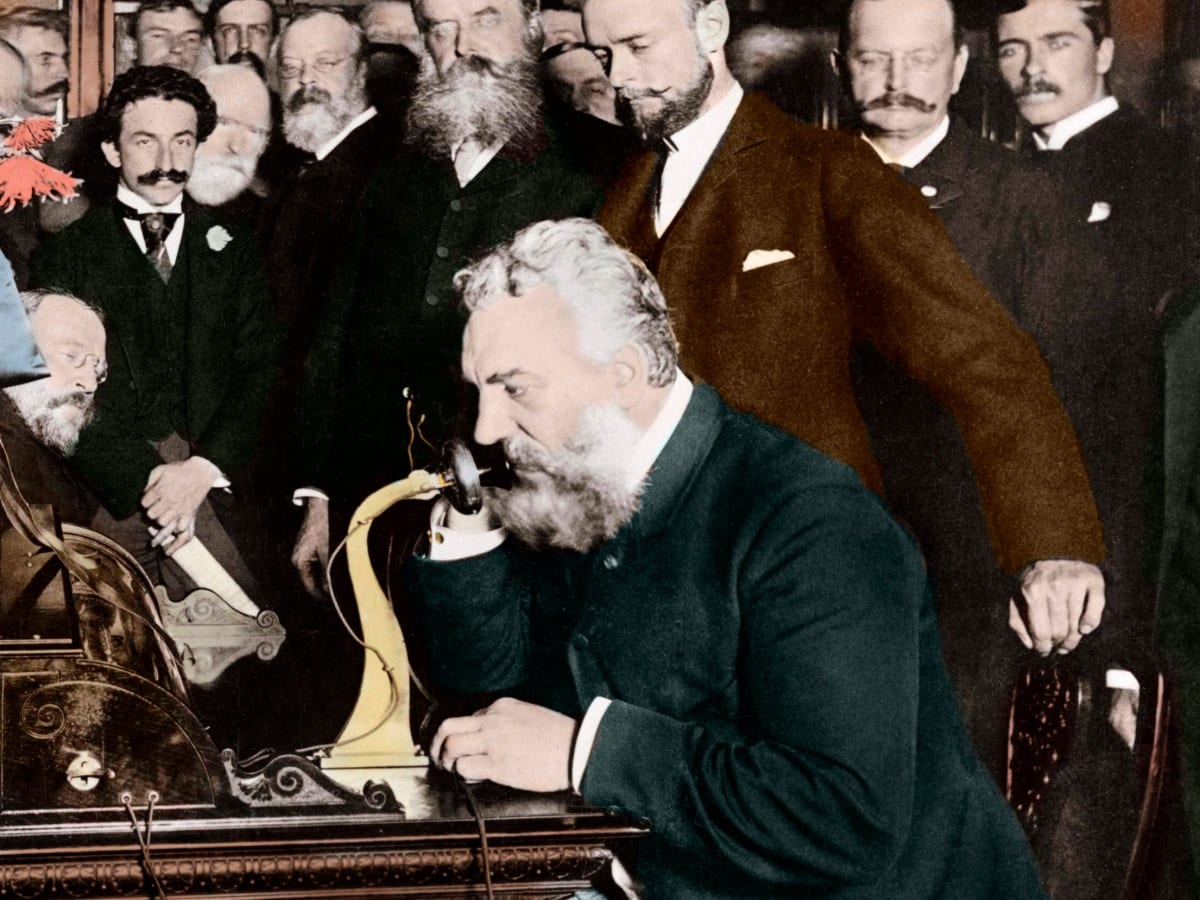

|

| 📞 March 14, 2017 Fintech Futures– “Reflecting on Bell’s birthday and his important contribution to how we communicate today, made me think about his unrecognised contribution to the financial services industry too”. |

| “Initially, the impact of the telephone on banking was evolutionary rather than revolutionary. It was not until 1980 that telephone banking system was launched. But since then, the rapid transformation in the ease, ways and how banks communicate and transact with customers around the world, is simply astronomical”. |

The 1880s - 1970s – Investing in communications infrastructures, such as the telegraph and transatlantic cables, enabled financial information to be transmitted across borders. With the invention of the Fedwire In 1915 the transference of funds between two parties was now feasible, but the central bank did not establish its own proprietary system until 1918. Until 1981 the Fedwire system was only available for member banks and services. In 1947, Bell-labs created the first transistor, which ultimately lead to electronic payment terminals. During the 1950s, credit cards were introduced, reducing the need for cash payments. The magnetic stripe on credit cards was invented by an engineer named Forrest Parry in the early 1960s. In 1969, magnetic stripes became the standard method for storing the cardholder’s account information on credit cards, an important event in the history of credit cards and payment processing.

It was during the mid-20th century that banking organizations and financial institutions started to heavily use technology as thier strategic advantage. For example, If I’m a hedge fund using an algorithmic trading strategy, time-to-market, or the rate at which I can execute a trade, can determine the success or failure of my fund. Speed has been one of, if not the most important problem space that hedge funds and other financial institutions are continuously optimizing for. A strategy popularized by financial institutions beginning in the 1960s. It was during this same period (1967-2008) that banks were leading the way, using technology to make the finance industry more efficient, during the shift from analog systems to digital.

In the 1980s, mainframe computers became increasingly popular in banks, and in the 1990s, online financial transactions became common. In the 1970s, SWIFT (Society For Worldwide Interbank Financial Telecommunications) and NASDAQ were established, as the first digital stock exchange.

|

| “Technology companies had been working on bringing automation to the stock market for years, with gadgetry such as the Telequote III dating to the late 1960s. But Bloomberg’s timing was fortuitous, even though the company got going during a raging recession. In the 1980s, stock exchanges from New York to Tokyo were going electronic, a prerequisite for a truly sophisticated online service for traders. It’s what enabled not only the Terminal but other devices such as 1984’s way-before-its-time QuoTrek, a wireless handheld gizmo for investors” |

Tech & Banking in the 21st Century

It was not until the 21st century that banking services truly became digitized, with a direct correlation to the rate at which smartphone adoption occurred. In response to the 2008 financial crisis, consumers completely lost faith in banks and the banking sector, leading to the creation of neo-banks, fintech, and Satoshi Nagimoto’s Bitcoin white Paper (Bitcoin: A Peer-to-Peer Electronic Cash System) , all of which were in response to the 2008 financial crisis. The solution to the banking crisis is to provide banking services that are simple, convenient, and trustworthy for all users, regardless of socioeconomic status. The largest banking opportunity is to provide these innovative banking services via mobile devices since there are now more mobile phone users than there are people with access to electricity.

According to a study by the Pew Research Center, 73% of Americans lack confidence in banks’ ability to handle their finances. This lack of confidence spans all demographics, with the exception of those over the age of 75. This staggering number indicates just how pervasive the financial crisis has been, and how far the industry has yet to recover.

In the current business climate, where consumers are demanding more transparency and control over their finances, startups that excel in engineering often find themselves at the forefront of their industry. Some of the major players in the fintech space that set the standard for modern-day business practices include, Paypal, Stripe, Plaid, Square-Block, and Venmo, to name a few. The incumbents, though often slow to follow the same trends, increased their efforts to directly compete with fintech, which can now be viewed as abstracted, but still a member of the overall banking sector.

💱 The Economics Of Fintech

New user-centered services grew exponentially during the 2008 Financial Crisis, as discussed previously in the Revolution section. Like the Great Recession, the COVID-19 pandemic forced users to try new digital-first banking solutions and day trading tools such as Robinhood enabled retail investors to invest more easily, during the same period.

Globally, the adoption of the sector has exploded, both in advanced economies and in emerging markets and developing economies (EMDEs). Despite the fact that fintech activities are relatively small in comparison with the overall financial system, some economies are seeing fintech as a significant economic driver. As of 2020, mobile payments accounted for 16% of China’s total GDP, but less than 1% of the USA. In emerging economies, fintech services have become a much more critical part of the economy as a whole.

A study of financial technology adoption in emerging markets can provide insight into the importance of financial inclusion for the fintech industry, worldwide. Although fintech is confined to certain business lines in some countries, it is moving into the mainstream of financial services in others. Neither economic development nor political boundaries appear to explain fintech adoption patterns.

🛠 Engineering Fintech

There has always been a unique relationship between companies providing financing and investment and technology companies themselves throughout the history of the technology revolution. The beginnings of the modern technology age can be traced back to companies such as Bell-Labs, and even as far as Thomas Edison and his Edison Company. The relationship between society and its innovators changed during the late 20th century. Americans seem to have a particularly close relationship with progress, investors, and technologists. This is likely due to the nation’s history of technological innovation.

Engineering Plaid

The problem space for Plaid and area of opportunity: The US Banking System is not unified or centralized, which is not the case for other countries. This alone is the business case their services solve for, providing an API, or Application Programming Interface, allowing developers to ingest data to their app or service, using Plaid’s platform. The use cases for Plaid are rather extensive but the core service offering is centered around connecting external apps to a user’s bank account. Some of the potential use cases include Personal Finance apps, Banking apps, E-commerce, Lending/ Borrowing, and Investments, to name a few.

The widespread use of APIs exposed an opportunity for Plaid– An API is a way for two or more computer programs to communicate with each other. It is a type of software interface, that offers a service to other pieces of software. An API specification is a document or standard that describes how to build or use such a connection or interface. A computer system that meets this standard is said to implement or expose an API– Plaid’s business model is entirely built around APIs, and would not have been possible without them.

Engineering Block

Another, often overlooked company championing the engineering-first movement in fintech, is Block, formerly called Square. Block is a POS (point of sale) company, at its heart, but manages a portfolio of fintech services beyond POS, such as CashApp. Jack Dorsey, Block’s illustrious CEO and Founder is a proponent of web3, in part, hence the change of name for the organization. In recent months, Dorsey has introduced a new marketing buzzword, Web5 during Consensus 2022, and a prelude to the public announcement of the internal efforts of Block to revolutionize the banking industry, using decentralized lender technology, and more specifically Bitcoin, in their case. I will go into more detail about this in the closing paragraphs of the Block section.

Ask any small to medium-sized business that switched to Block (SQUARE) from another, less innovative provider, you will hear tales of the POS platform saving thier business, reducing overhead, and retaining more customers. Block also owns CashApp, a service that is being used more and more by average consumers for general-banking needs: peer-to-peer money transfers, and paying for goods and services. Block-Square also has mobile POS, Kitchen Display, Kiosk, and Time and Attendance applications for time management.

The first POS system was technically the cash register, which was invented in 1870 by a saloon owner named James Ritty. What the cash register enabled was an error-free transaction, allowing for better management of capital and bookkeeping. The first electronic PB-based POS system was launched in 1985 by IBM. The primary limitation of these first electronic systems was that owners or operators had to maintain both the software and hardware, greatly increasing complexity and the need to source experienced IT Technicians. The first cloud-based systems were introduced in 2002.

In 2010, Square launched the first app-based card reader to plug into smartphones, which was the first mobile POS for receiving and submitting payments. The introduction of the smart-phone enabled POS represented a touring point for the industry. Square later released their well-designed hardware-based products, once again disrupting the POS market through innovation, engineer-first, and user-friendly development principles, taken from the cookbooks of so many successful technology companies before them.

|

| “In 2009, Square was launched as a simple, elegant, and inexpensive solution to a problem facing millions of small businesses across the U.S. and around the world—how to easily and conveniently accept credit card payments at the point of sale without being hammered by prohibitively expensive merchant services fees”. |

Consensus 2022 , a web3 conference - Block, the parent company for Square, announced that TBD, which is the Bitcoin arm of Block released their Web5 deck, highlighting the company’s plans to use Bitcoin and decentralized ledger technology to revolutionize the banking industry, globally.

“We believe in a decentralized future that returns ownership and control over your finances, data, and identity. Guided by this vision, TBD is building infrastructure that enables everyone to access and participate in the global economy.”

De-tokenization, or the lack of multiple tokens that support the ecosystem, is an important difference between web3 and web5. Within the web5 ecosystem, there will be a single token to exchange value. With Bitcoin as the single token, or currency, that powers the network, users will be put first, and intricacy will be greatly reduced, lowering the barrier to entry for non-technical users, based on thier thesis.

“Some people seem to think we are joking about web5 and we are not for real working on it. I promise you, that we are for real working on it. It will actually exist, unlike web3.”

Initial reactions to his claims were mixed, with many users more or less interested in his overall claims of web5 having the potential to revolutionize the tech industry as a whole. The general consensus seems to be that both web3 and web5 will operate collectively, whereas web5 can be viewed as the reserve currency of this new financial infrastructure. I personally do not believe decentralized ledger technology holds quite as much potential for mass adoption as some may believe it has, but I do believe It represents a new asset class that will only grow in the coming years and decades. Pointing back to the rate of adoption outlined in this article, I believe it’s highly probable that we will see adoption for web3 vary greatly depending on region and country.

|

| “The web democratized the exchange of information, but it’s missing a key layer: identity. We struggle to secure personal data with hundreds of accounts and passwords we can’t remember. On the web today, identity and personal data have become the property of third parties”. |

| “Web5 brings decentralized identity and data storage to your applications. It lets devs focus on creating delightful user experiences, while returning ownership of data and identity to individuals.” |

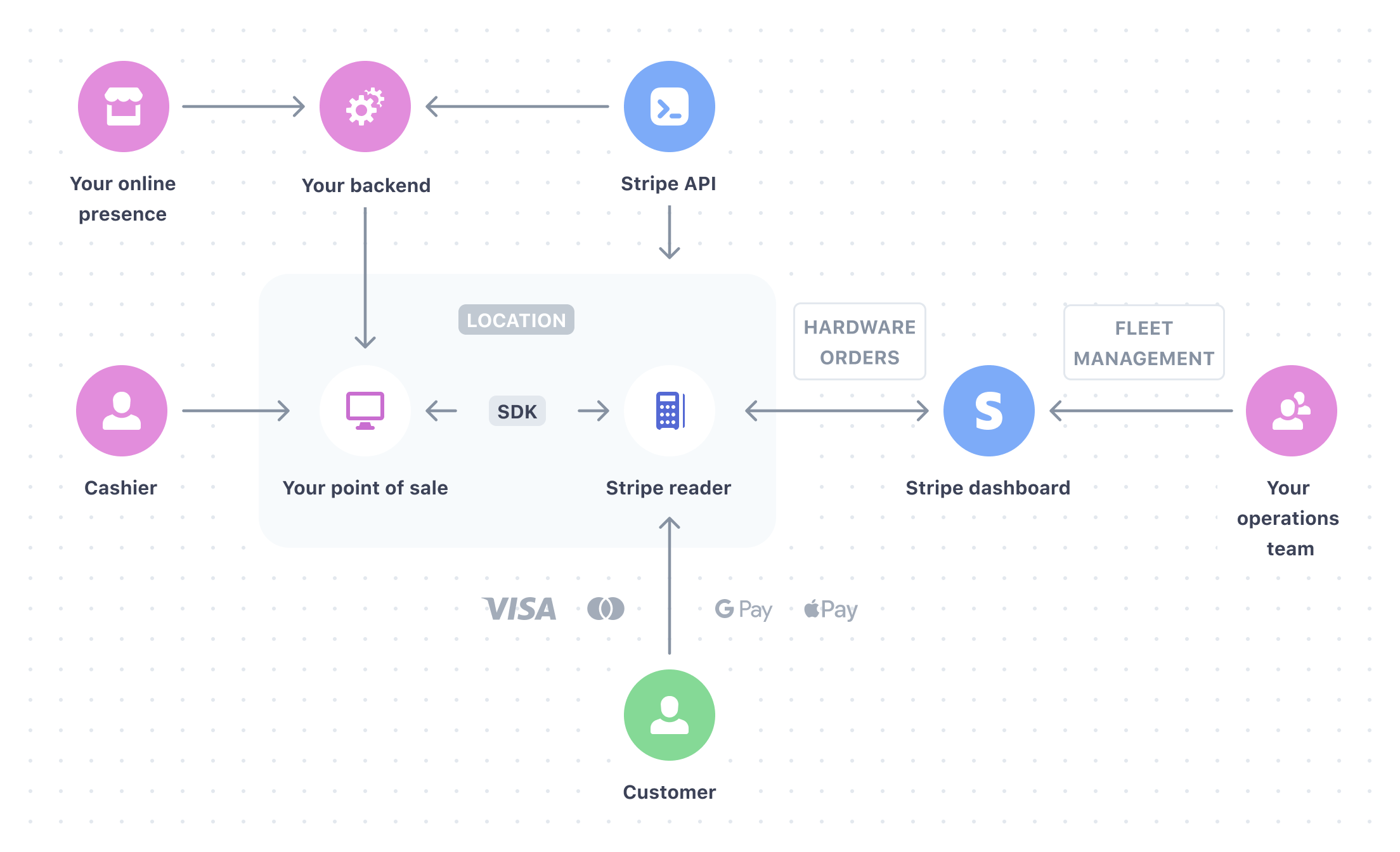

Lastly, in terms of reviewing the engineering practices of the most performant technical teams in Fintech, we have Stripe, a company that offers payment infrastructure as a service, which greatly reduces backend complexity for developers and engineers. Thier suite of financial solutions is marketed as the technology-first solution for internet businesses, offering the most performant APIs and SDKs in the industry.

In most digital applications or services, no matter the sector, the payment, and checkout flow is one of the most common steps in the customer journey. By providing a developer-first and API-first payment infrastructure service, Stripe has helped to solve one of the most common engineering problems, and one of the biggest pain points for product teams, designing and developing payment, checkout flows, and implementing financial/payment infrastructure–– For example, rather than deploying a UI/UX designer to design the payment flow for your business or application, Stripe’s low-code checkout flow allows designers to easily create branded and unique payment/ checkout flows without the need of designing a solution from scratch. The designer and product manager can create the acceptance criteria for the developers, saving hundreds of hours of combined capacity and team availability. Some of the additional services that Stripe offers include: Billing, Invoicing, Taxation, KYC(identify), and crypto payment rails, to highlight a few.

|

| “For ambitious companies around the world, Stripe makes moving money as simple, borderless, and programmable as the rest of the internet. Our teams are based in dozens of offices around the world and we process hundreds of billions of dollars each year for startups to Fortune 500s.” |

The major US banks and financial institutions caught onto the fintech trend early, with acquisitions following closely. As of 2022, most banks have developed their engineering teams into innovation-first, and engineering-first institutions. One example is Bloomberg, which is viewed as a Financial Services company, which had thier start by selling the Bloomberg Terminal, which is a software/hardware product. As such, they have been innovating since the beginning of the internet. Banks such as Citi, and Goldman Sachs, have also adopted more engineering-focused approaches to solving both customer and business problems, a trend that can be identified across the entire banking and financial services sector.

🦅 The Politics of Fintech

Several political factors influence the ability of fintech companies and innovative financial services to identify product-market fit. We previously reviewed how the rate of adoption changes greatly depending on the geographic region…

The Chinese Communist Party (CCP) has taken a stricter stance on digital banking services and outright banned cryptocurrencies and decentralized ledger-based technologies. The lack of centralization in these technologies stands in direct contrast to the political dynamics of the communist party. Though cryptocurrencies have been banned, the central government in China has championed digital-first banking. This is because digital banking is more easily governable and monitorable than physical cash payments, which are much more complex to monitor. Therefore, we can easily come to the conclusion that digital-first banking is a strategic advantage for any government that holds absolute power. A government that is willing to implement controls to ensure none of the said power wanes or diminishes due to the use of any individual technology, regardless of its usefulness to society, can benefit from digital-first banking.

Fintech companies have to adhere to the guidelines set by regulatory authorities closely but do have certain advantages when it comes to operating digital banking services. Regulatory entrepreneurship can upend markets by operating in legal gray areas before enlisting customer groups to champion regulatory change. Fintech has often been likened to the Uber of banking, with companies employing similar regulatory innovation/ practices to skirt local policies and laws.

Some say that fintech is a by-product of the wider economical process known as ‘financialization.’ Financialization is when financial motives, institutions, and markets play a bigger role in the global economy. Fintech is said to be speeding up financialization by finding new ways for financial activity to happen and by making financial transactions cheaper. As financialization happens more and more, society becomes more unequal and unstable.

✌ Conclusion

The fintech industry has seen an increase in mergers and acquisitions over the past few years, with Visa attempting to acquire Plaid. Apart from the companies mentioned in this post, there has also been a revolution in lending and borrowing, with services such as Affirm, and in insurance, with new, innovative solutions, disrupting the status quo and gaining market share from legacy companies like New York Life by providing easier-to-understand insurance products. It has become increasingly difficult for incumbent financial services companies to recognize customers’ pains and problems in the wake of the Great Recession and the COVID-19 pandemic, and I predict that the trend will continue.

Globally, $133B USD was invested in Fintech during 2021, almost three times as much as the $49B USD invested the previous year. Some of the key focus areas for this inflow of capital include Bitcoin and decentralized ledger technology(DLT), bank-to-bank payments/ peer-to-peer, buy-now-pay-later and insurance-tech companies. Another company to watch out for in this space is GrowCredit , which solves the problem of obtaining credit without any prior credit history, and Melio, which simplifies business payment processing. “Pay vendors, suppliers, and contractors the way you want.”.

In the opinion of Jamie Diamon, fintech presents a significant threat to traditional financial services companies and the banking industry. In my opinion, Fintech does not necessarily disrupt the overall banking industry, since many Fintech services essentially plug into traditional/legacy banking systems. Although they may disrupt individual services, I do not believe they pose an existential threat to the overall existence of the legacy banking and financial services industry.

It’s an exciting time to be involved in fintech or technology and I look forward to seeing what innovative solutions come to market. During a follow-up post, I will provide more details about specific technologies, often referencing this article.

I greatly appreciate you taking the time to read through my content. Please use the form section to submit suggestions or general comments about my content, the subjects covered, or my writing style.

👾 More Recent-Posts

-

Bitcoin (BTC) Revolution: Catalyst, History, and Analysis

The main goal of this piece is to gain a deeper understanding of the reasoning behind the creation of Bitcoin, allowing for a more comprehensive perspective on its future

-

Macro & Geopolotics Report: 2023 Business Trends Report

In this post, we discuss macroeconomics, as well as geopolitics as part of the 2023 Business Trends Report 🌍

-

💲NEAR Protocol: Overview and Price Prediction

In this article, we will be conducting an extensive analysis of the 💲NEAR protocol, which is the platform I have the most experience building dApps on, as a Product Manager in web3

-

8 Healthcare Industry Trends and Innovations

In this post, we will be reviewing 8 business trends for the healthcare industry, including each of it's sub-industries, such as MedTech🔬

-

Cardano(ADA) Overview and Price Prediction

As a part of this post, we'll be reviewing what Cardano (ADA) is, its benefits, Tokenomics, a price prediction model, and the future of its fledgling ecosystem 💱

-

Ruby on Rails and The Future Of MVC

Discover the amazing potential of Ruby on Rails! Learn about its history and design philosophy, why it's the perfect choice for web development, and how to get started with the framework ♦️

-

Artificial Intelligence: Business Trends Report

Large language and generative models are reaching a point of emotional realness that they can no longer be distinguished from humans 🚀

-

2023 Geopolitics Report

A guide to help both businesses and product managers use geopolitics as a strategic advantage in 2023

-

Post-Industrial Digital Banking

Explore the post-industrial era of digital banking. Deployment-based market research, post-industrial hypothesis validation,opportunities,and more 📲

-

How 👾 (AI) Will Transform Product Management

In this post, we will unpack how (AI) will transform aspects of product management, as well as it's impact across cross-functinoal teams 🎖️

-

2023 Transportation Industry Trends 🚊

In this post, we will be covering 2023 Transportation Industry Trends, including market research, business strategy, and more... 🚉

-

Energy Sector Forecast 2023 ⚡

The 2023 Business Trends Report covers sector-based projections, major innovations, market dynamics, opportunities, and technologies by sector or industry - this post covers both traditional and renewable energy markets 📈

-

To-Blog Or Not-To Blog❓ | 2023 Blog Launch Helper |

This post is designed to help you or your team launch and optimize a successful blog by examining why businesses blog, providing a blog business plan guide, exploring SEO and analytics tools, and an overview of blogging platforms and frameworks

-

Make the web fast again | What is a CDN❓| How do CDNs work❓

In this post, we review what a CDN is, how they work, the business of cdns, as well as some of the best options to consider when choosing a cdn

-

We're In Way Over Our Heads | Going Headless (CMS)

Content is king! In this post we review Headless-CMS, content management systems; How they work, an overview of JAMstack, some of the best options, etc, will be discuessed

-

Building Static Websites In An Un-Static-World (SSGs)

In this post we'll be reviewing (SSGs) static site generators, reviewing the tech as a means of providing value to your next project or business during times of uncertainty– The advantages, how they work, and evaluating frameworks, including Jekyll, Hugo, and Gatsby. JS, etc 🛠

-

How (AI) is changing the way we work

In this post, we'll explore two use cases for (AI) ⚔️ (AI) Writing and Text-To-Image (Generative-AI) – How they work, as well as their current and future, use cases for the workplace, as well as available tools and services

-

Industrial Revolutions

Part-1 (1-2 IR) This is the first post of the Industrial Revolution series, covering the 1st and 2nd Industrial Revolutions, major tech innovations and advancements during each period

-

Industrial Revolutions

Part-2 (3-4 IR) This is the second and final post of the Industrial Revolutions series, covering the 3rd and 4th Industrial Revolutions. Focusing on the tech and innovations during this period

-

Tokenomics

Ledgers and Accounting represent two foundational aspects of tokenomics and token-engineering, this is the first of many post where I will be covering tokenomics, focusing on presenting my research and aspects of system design

-

Web 3 Systemic Issues Report

In this post I review some of the most systemic-issues that I have identifed after contributing to a few web3 startups in varying levels of involvement – please take what is stated as speculative conjecture, nothing more 🙏