💲 Intro

The NEAR Protocol (NEAR) is a self-governing, open-source, layer-1 blockchain ecosystem that uses a proof-of-stake (PoS) consensus mechanism to validate transactions. An ERC-20 token architecture is used in the native token and smart contract, which is a derivative of Ethereum protocol standards. The NEAR ecosystem is governed through multiple innovative ORG structures, including DAOs, and guilds, and offers ecosystem grants to incentivize development, adoption, and retention among each of the target user groups: designers, analysts, researchers, developers, etc., and the end user.

The ecosystem-wide objective of NEAR has been to facilitate the mass adoption of blockchain, by offering a rich service offering from Defi (decentralized finance), DEX’s (decentralized exchanges), cross-chain interoperability through The Rainbow Bridge, and Aurora, and a healthy NFT community working together to identify the true value proposition for non-fungible tokens (NFTs), among other decentralized-ledger technology use cases.

☑️ Topics Covered

In this post, we’ll be unpacking the NEAR Protocol. We’ll begin by reviewing an overview of NEAR, followed by Sharding and Tokenomics. For the next bucket, we will review an overview of the NEAR ecosystem. Moving on, we will evaluate some of the companies, projects, and communities building on top of NEAR and will conclude with a price prediction and technical analysis for NEAR, as the native token of the NEAR Protocol.

☑️ Building Empathy

I have personal experience building dApps on the NEAR protocol as a Product Manager, where I led a team building an NFT Marketplace, defining our business, product, and content strategies, as well as hiring, and developing team members, general project management tasks, and implementing stying, among many other core tasks.

🧩 Table of Contents:

💲 What is NEAR Protocol?

The $NEAR Protocol is an open-source high-throughput layer-1 blockchain that uses proof-of-stake (PoS) and sharding techniques to facilitate rapid transactions (100,000/per second). Its smart contract is designed based on the ERC-20 smart contract standard, which allows developers with prior experience building on networks such as ETH to onboard hastily and scales applications and services rapidly.

By introducing user-friendly services that allow users to interact with dApps without needing to understand the underlying technology, NEAR Protocol solves a few business and customer pain points that have made gen 1 and gen 2 blockchains’ less feasible for many user groups and segments.

The mission, and vision of the NEAR Foundation; NEAR wallet, university, etc, are to facilitate mass adoption of blockchain by offering onboarding solutions and customer acquisition tools that make it progressively more simple to get up and running with the network, presenting the core utility of blockchain to the new user segment with no prior experience in web3. Most alternative blockchain ecosystems require users to interact with a third-party wallet such as Metamask, whereas the NEAR wallet is easier to learn and use.

The nature of web3 is decentralization, though many companies, and services, are using centralized strategies as a way to ramp up engagement on their network, and will become increasingly more and more decentralized over time. This customer acquisition strategy makes a great deal of sense to me personally, which I have seen firsthand within the NEAR ecosystem. Design centralized processes to ramp up ecosystem growth, development, and customer acquisition, and then progressively pivot towards more and more decentralization.

The ERC20 smart contract standard defines a set of rules for tokens, which can be individual assets or groups of assets on any given blockchain (network). Smart contracts based on the ERC20 standard can be implemented as NFTs, derivatives contracts, or native tokens, such as NEAR.

Furthermore, NEAR’s network is a carbon-neutral system and was awarded a climate-neutral product label by the South Pole organization, to ensure the network is devoid of carbon dioxide (CO2) and other greenhouse gas-producing operations, which has been pointed out as one of Bitcoins greatest challenges.

🌕 NEAR Protocol Sharding

NEAR uses a novel proof-of-stake consensus mechanism to validate transactions, which makes it more sustainable than its BitCoin counterpart by delineation, as well as ETH classic which also uses a proof-of-work (PoW) consensus mechanism to validate transactions, similar to BTC; thereby raising the barrier to entry and creating a more complicated ecosystem to onboard and activate new users.

The low throughput of Ethereum (ETH), which can only process 20 transactions per second via its primary chain, leads to high gas prices and prevents many user groups from adopting the network for general value transfer, payment processing, or other types of transactions, for example – Gas prices can be compared to processing fees in traditional payment processing. The average transaction on ETH takes 1.5 minutes, despite a new block being added every 10-20 seconds. A low transaction throughput, a high barrier to entry via costs, and a low processing time via latency are all examples of pain points experienced by ETH users, leading to networks such as NEAR and Solana.

In response to these pain points, NEAR introduced an elegant solution to ETH and other networks’ scaling problems called nightshade, which uses sharding, which is a chain splitting method, or database partitioning method by splitting the work of processing transactions between many participating nodes. You can read more about Nightshade’s technical implementation in the incredibly thorough post NEAR published about sharding and Nightshade in particular.

🪙 Near Protocol Tokenomics

Inflation: Upon genesis, there were 1 billion NEAR tokens created – New NEAR tokens are generated at a rate of 5%(Rate of inflation) of the net supply in circulation every year, with the aggregate of the newly minted tokens being given to validators as a way to incentivize staking.

Deflation: Fee burn mechanism comparable to the EIP-1559 standard employed by ETH. As engagement and transaction volume increases, the network becomes disinflationary. Based on the average throughput of 1.5 Billion TPS, net token supply decreases by 0.457% per year.

Transaction fees: NEAR has a novel way of facilitating transactions and dealing with gas prices, designed uniquely to incentivize developers to build on the network. With each transaction, 30% goes to the smart contract provider, and 70% is burned. Additionally, NEAR allows you to call read-only contracts for free. 1 TGas (10¹² gas units) ≈ 1 millisecond of “compute” time, which represents 0.1 milliNEAR. To execute transactions NEAR uses a web assembly virtual machine (VM).

For a deep dive into the economics of NEAR, check out this post for more information.

🏠 Near Protocol Ecosystem Overview: “Building the open web together”

The NEAR Protocol ecosystem consists of a number of different components, including the NEAR Protocol which is the blockchain network itself, the native NEAR Token, Near University, and the NEAR Foundation which is the non-profit arm of NEAR leading the development of the ecosystem through a top-down decentralized governing style, among other governing bodies, parallel projects such as Aurora, and includes each of the independent projects building on top of the NEAR network partially or community-funded through DAOs, grants, or guilds. There are currently ~ 1,000 active projects, startups, and companies building on top of NEAR, with ~ 125 DAOs functioning within the ecosystem, which shows a long-term commitment to the protocol.

“DAOs offer a new way for communities to collaborate. Members own the organization and receive rewards in proportion to their contributions. There are no bosses and no hierarchy. Instead, a common purpose unites the participants. One way to think of a DAO is a Facebook group with its own bank account”.

It’s worthwhile to raise a few additional points about optimizations around developer experience (DX). One of the chief advantages of NEAR is that it’s simpler to build, scale, and deploy dApps on the NEAR network than many of its competitors. Developers and teams also have access to starter projects which can greatly reduce time-to-market for new apps, and removes a great deal of complexity.

Developers building on the NEAR network can build smart contacts with either Rust or Javascript. And lastly, the other community-driven bucket that NEAR has been pushing forward has been their learning material and resources for developers which has been pointed out throughout this post.

Recently, NEAR wallets created have surpassed 10 million which is a major milestone for the network, across each continent and demographic background – There are currently 550k members within the ecosystem and 4k developers building or deploying applications on top of the network.

Over the last few years, new users have funneled into web3 ecosystems as a way to remain engaged in communities centered around yield, or another form of value, but activation has slowed down substantially as a result of the current bear market conditions. How do you show the basic utility of a decentralized ledger technology service? As the base case, optimizations around usability are the first focus as we’ve already reviewed, but should be emphasized to reaffirm the point.

As the secondary order of business: providing tokenomics that can facilitate high-throughout transactions and fees low enough to support all user groups, independent of demographic background or technical knowledge. Additionally, facilitate and incentivize the development of innovative projects and products being built on top of the network by offering ecosystem grants, investment, learning material, as well as other strategic relationships to support each user group within the ecosystem, therefore, benefiting the entire ecosystem and providing utility=value to the entire community, in aggregate.

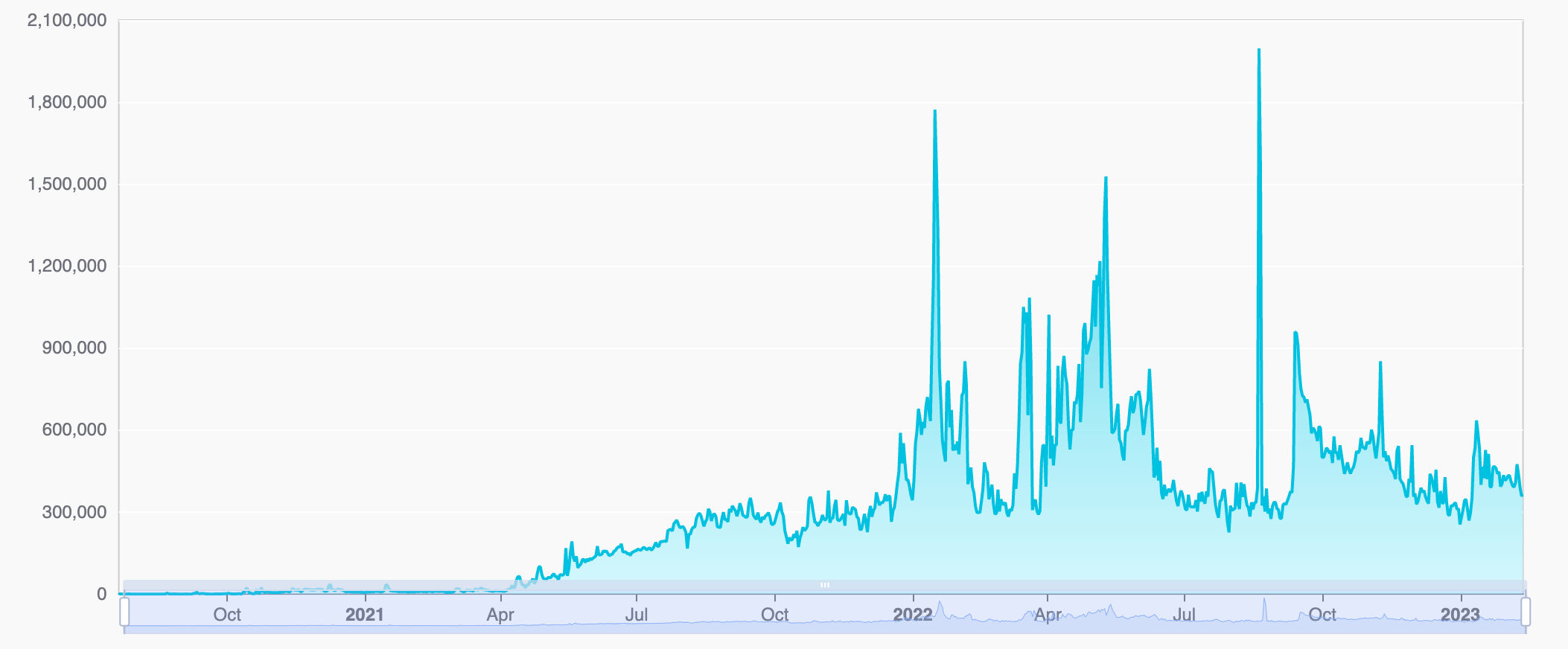

📶 NEAR Protocol: Daily Number of Transactions

🏗 NEAR Protocol Innovative Projects and Companies

☑️ Ref Finance: (REF) is the default full-service Defi platform on NEAR, offering a platform to facilitate a wide scope of Defi services for users of NEAR and Aurora. They also offer an SDK that allows developers to build and deploy Defi services on top of their network – Their primary goal was to homogenize the core components of Defi together, including the DEX, lending protocol, synthetic asset issuer, and more.

The accumulative trading volume for Ref is approximately $5.3 billion USD, but the total value locked (TVL) is ~$62.83 million USD to NEAR, as of 2-12-2023.

☑️ Aurora: Aurora is an Ethereum (ETH) layer-2 network and ETH virtual machine, built on top of NEAR. It has been designed as an Ethereum scaling solution to solve many of ETH classic’s core pain points, including the high barriers to entry due to costs, low throughput, etc.

The Aurora Network provides infrastructure for cross-chain smart contract deployments and network interoperability– In the last 30 days, Aurora’s price has rebounded a bit and total trading volume has increased, which is a positive sign given the current market conditions.

☑️ Rainbow Bridge: A service designed for permissionless transfers between ERC-20-based tokens (NEAR and ETH), or between other ERC-20-based chains.

☑️ Octopus Network: As a multichain, interoperable network, Octopus allows projects to deploy applications on top of thier application-specific blockchains. One of the core use cases is the ability to transport data between two separate and distinct networks.

As a result of current conditions in web3, and in order for Octopus Network to continue to deliver on its roadmap, the company will be cutting staff, and all remaining staff will be given a 20% pay cut – You can learn more about this news by reading this post from Decrypt.com, which discusses both the strategic objectives of the company, as well as a general overview of the company.

☑️ Learn NEAR Club: LNC is a decentralized learning platform for the NEAR ecosystem that offers courses, and certificates, using the (L)Earn learning method to incentivize learning/engagement. Students that participate earn (nLearns) points as a reward for their efforts. Both the course creators and learners earn nLearns for their efforts.

The primary use case of nLEARNs is proof that the material was learned, or Proof-of-(L)Earn, which can therefore be verified by community members, or used as a way to more easily hire, or onboard members for a project. Using onboarding guides and designation-specific certificates, Learn Near Club offers tools to support customer acquisition, activation, and engagement among each targeted user group, from designers to analysts.

☑️ Trisolaris: A decentralized exchange (DEX) using Aurora’s engine that offers one-stop trading for NEAR protocols. This is Aurora’s first DEX and provides a user-friendly experience comparable to native ETH but at a fraction of the cost.

Some of the core value propositions are blazingly fast trades, which are fulfilled in less than a fraction of a second, and at a fraction of the cost of ETH, as well as any other competing ETH L2 network. They have created an incentivized trading experience for the NEAR protocol, with the ability to provide liquidity and swap any ERC20 token, as well as a liquidity mining incentive.

Since March 2022, 24hr volume has decreased significantly due to current market conditions.

📉 📈 NEAR Protocol Price Prediction?

🔘 The price of NEAR has been steadily increasing since its launch in 2020. According to CoinMarketCap, the current price of NEAR is $1.86. Analysts predict that the price of NEAR will continue to increase as more companies build on the platform and the network grows.

🔘 Based on the prediction model provided by Changelly, NEAR will hover around $1.97 USD in 2023, with an average price of $4.24, and a max price of $4.82 NEAR to USD for 2023. This same model has NEAR increasing to as much as $5.67 USD by EOY 2024, and reaching $42.29 as the max price estimate in 2032.

🔘 Defi TVL has decreased to roughly $95 million USD from over $700 million at its highest market cap. Rer Finance is still leading the Defi landscape for NEAR controlling 56% of the market.

🔘 Total value locked (TVL) is currently around $250 million USD, which is down significantly from its highs of over $ 1 billion USD TVL during the peak of the bull market in 2021.

📊 Near Protocol Technical Analysis

As of 2-12-2023: “ According to our current NEAR Protocol price prediction, the value of NEAR Protocol is predicted to drop by -4.20% and reach $ 2.11 by February 18, 2023. According to our technical indicators, the current sentiment is Bearish while the Fear & Greed Index is showing 48 (Neutral). NEAR Protocol recorded 15/30 (50%) green days with 6.37% price volatility over the last 30 days. Based on our NEAR Protocol forecast, it’s now a bad time to buy NEAR Protocol”.

🌐 🎖️ Closing Thoughts

The NEAR ecosystem and cryptocurrency are among the top 20 cryptocurrencies and ecosystems with a vibrant community surrounding them. Despite the current market conditions, which have prompted detractors to distrust blockchain, or those who view it as an existential threat to the status quo, in other words, tradition, it is highly likely that NEAR will continue to grow.

NEAR Protocol was developed to address a number of gen 1 and gen 2 pain points and limitations/use cases, including scalability, high transaction fees, and usability, among others, and to facilitate mass adoption of blockchain as a result. Through its ecosystem, NEAR Protocol enables developers to build decentralized applications (dApps) quickly and easily by removing as much complexity as possible, offering starter projects that can also decrease time to market.

In this post, we discussed many of the fundamentals of the NEAR Protocol, an overview of the network, sharding, tokenomics, ecosystem development, innovative businesses that are building on NEAR, and Aurora, as well as some price predictions, and technical analysis.

👾 More Recent-Posts

-

Bitcoin (BTC) Revolution: Catalyst, History, and Analysis

The main goal of this piece is to gain a deeper understanding of the reasoning behind the creation of Bitcoin, allowing for a more comprehensive perspective on its future

-

Macro & Geopolotics Report: 2023 Business Trends Report

In this post, we discuss macroeconomics, as well as geopolitics as part of the 2023 Business Trends Report 🌍

-

8 Healthcare Industry Trends and Innovations

In this post, we will be reviewing 8 business trends for the healthcare industry, including each of it's sub-industries, such as MedTech🔬

-

Cardano(ADA) Overview and Price Prediction

As a part of this post, we'll be reviewing what Cardano (ADA) is, its benefits, Tokenomics, a price prediction model, and the future of its fledgling ecosystem 💱

-

Ruby on Rails and The Future Of MVC

Discover the amazing potential of Ruby on Rails! Learn about its history and design philosophy, why it's the perfect choice for web development, and how to get started with the framework ♦️

-

Artificial Intelligence: Business Trends Report

Large language and generative models are reaching a point of emotional realness that they can no longer be distinguished from humans 🚀

-

2023 Geopolitics Report

A guide to help both businesses and product managers use geopolitics as a strategic advantage in 2023

-

Post-Industrial Digital Banking

Explore the post-industrial era of digital banking. Deployment-based market research, post-industrial hypothesis validation,opportunities,and more 📲

-

How 👾 (AI) Will Transform Product Management

In this post, we will unpack how (AI) will transform aspects of product management, as well as it's impact across cross-functinoal teams 🎖️

-

2023 Transportation Industry Trends 🚊

In this post, we will be covering 2023 Transportation Industry Trends, including market research, business strategy, and more... 🚉

-

Energy Sector Forecast 2023 ⚡

The 2023 Business Trends Report covers sector-based projections, major innovations, market dynamics, opportunities, and technologies by sector or industry - this post covers both traditional and renewable energy markets 📈

-

To-Blog Or Not-To Blog❓ | 2023 Blog Launch Helper |

This post is designed to help you or your team launch and optimize a successful blog by examining why businesses blog, providing a blog business plan guide, exploring SEO and analytics tools, and an overview of blogging platforms and frameworks

-

Make the web fast again | What is a CDN❓| How do CDNs work❓

In this post, we review what a CDN is, how they work, the business of cdns, as well as some of the best options to consider when choosing a cdn

-

We're In Way Over Our Heads | Going Headless (CMS)

Content is king! In this post we review Headless-CMS, content management systems; How they work, an overview of JAMstack, some of the best options, etc, will be discuessed

-

Building Static Websites In An Un-Static-World (SSGs)

In this post we'll be reviewing (SSGs) static site generators, reviewing the tech as a means of providing value to your next project or business during times of uncertainty– The advantages, how they work, and evaluating frameworks, including Jekyll, Hugo, and Gatsby. JS, etc 🛠

-

How (AI) is changing the way we work

In this post, we'll explore two use cases for (AI) ⚔️ (AI) Writing and Text-To-Image (Generative-AI) – How they work, as well as their current and future, use cases for the workplace, as well as available tools and services

-

Industrial Revolutions

Part-1 (1-2 IR) This is the first post of the Industrial Revolution series, covering the 1st and 2nd Industrial Revolutions, major tech innovations and advancements during each period

-

Industrial Revolutions

Part-2 (3-4 IR) This is the second and final post of the Industrial Revolutions series, covering the 3rd and 4th Industrial Revolutions. Focusing on the tech and innovations during this period

-

Tokenomics

Ledgers and Accounting represent two foundational aspects of tokenomics and token-engineering, this is the first of many post where I will be covering tokenomics, focusing on presenting my research and aspects of system design

-

Fintech Deep-dive

How the tech industry is changing finance: This post outlines the history of financial technology (FinTech) and major innovations, as well as companies at the forefront of this sector

-

Web 3 Systemic Issues Report

In this post I review some of the most systemic-issues that I have identifed after contributing to a few web3 startups in varying levels of involvement – please take what is stated as speculative conjecture, nothing more 🙏