₿ Introduction

Throughout the most recent business cycle, Bitcoin (BTC) has been one of the most talked-about topics in the finance and tech worlds, attracting both talent and capital from traditional institutions. After its meteoric rise in value, it has become a source of fascination for developers building dApps, investors, and traders investing in crypto and other blockchain assets, and, as a result, a target for web3 detractors, as the collapse of FTX recently reinforced – What does the future hold for Bitcoin (BTC) in light of each of these factors? and what impact will recent market conditions have on the industry in the long run?

🏋️♂️ Post Objectives:

The primary objective of this piece is to better understand the why around Bitcoin’s creation, thereby have a better understanding of its future. In doing so, we will also discuss the 2008 financial crisis, including MBS, CDO, and modern monetary theory (MMT). Once we have a clear understanding of what led to the creation of Bitcoin (BTC), we will look at its history, including preliminary research conducted by groups such as the Cypherpunks, which included David Chaum, who was the first person to launch a digital currency based on cryptography and founded both eCash and DigiCash.

Once our historical foundation is set, we will move on and discuss some of the mechanics of bitcoin development, including the hard forks of bitcoin. Next, we will review Michael Saylor, CEO of Microstrategy, and one of the most prominent proponents of bitcoin.

Our final bucket of information will include Bitcoin’s ecosystem growth, long-term predictions, as well as partial price analysis, and technical buy/sell signal.

💲 Bitcoin (BTC) value prop

The utility of token-based networks is unequivocal as I have noted in my previous posts, research, and articles on crypto, web3, and blockchain. Crypto is, however, a highly volatile asset class that should be viewed as a gamble, especially until industry regulations and industry standards are more in place. This post is purely for research purposes and does not constitute financial advice.

🧩 Table-Of-Contents:

📉 Great Recession as the catalyst to BitCoin’s creation (Crypto Currencies)

The root cause of the 2008 financial crisis was the subprime defaults and subsequent MBS (mortgage-backed securities) and collateralized default obligations (CDOs), which were created as a form of insurance, or as a way to diversify, on tranches of subprime debt; packaged into new financial instruments to make them appear less risky on balance sheets and income statements, resulting in the 2008 financial crisis.

Capital invested in CDOs skyrocketed from $30 billion USD in 2003 to $225 billion USD in 2006. A total of $8 trillion in real estate debt was accumulated before 2008, a percentage of which was subprime.

Due to banks’ and institutions’ exposure to such assets, the correction in the housing market led to the downfall of the entire financial system. CDOs were backed by MBSs, and when the housing market collapsed, the entire market did as well. In spite of this, it was not the derivative products themselves that were the problem, but rather the lack of regulation of these assets; the sub-prime loans being given out at an alarming rate to homeowners who had no business taking out a mortgage in the first place.

🏚️ Understanding CDOs and MBSs

What are MBS (mortgage-backed securities)? MBS is a type of debt-based security backed by a pool of mortgages, and in exchange for their capital, investors receive a share of the interest and principal payments made by borrowers on the underlying mortgages. The cash flow from the underlying mortgages pays the investors in the MBS.

What are CDOs (collateralized debt obligations)? In a CDO, various types of debt instruments are pooled and backed by a predetermined rate of return for investors. Cash flows from the underlying debt instruments are used to pay CDO investors.

🏦 2008 Financial Crisis: The capitulation of the real estate market

Identifying the root of the problem requires peeling back the layers and identifying those who gave out loans to homeowners…

In essence, Fannie Ma and Freddie Mac were government agencies, serving the interests of bankers and loan brokers pushing homeowners into terrible mortgage loans. This series of events can be viewed as peak capitalism, and as a result of financial companies and institutions operating without accountability. Much of what we were seeing in web3 in 2021 is another example of peak capitalism, or the end of a market cycle, in my opinion.

This series of events sent shockwaves through the global economy and had lasting effects to this day. The stock market in the United States experienced its worst downturn since the Great Depression. Millions of people lost their homes, businesses failed and became insolvent, and millions of jobs were lost as a result of the crisis, which has caused a severe recession now referred to as the Great Recession due to its magnitude and impact when compared to every prior contraction between 1929 and 2008.

In order to save banks and revive the economy, governments worldwide had to take unprecedented measures through quantitative easing, injecting trillions of capital into the world economy. Quantitative easing (QE) has continued until recently, as the 2008 financial crisis continues to affect the functioning of the global economy: currency debasement, inflation, devaluing fiat currencies, etc, which presents some of the base cases for the rise of Bitcoin and other cryptocurrencies.

🗽 Modern Monetary Theory (MMT) and Laissez-faire economics

Prior to the 2008 financial crisis, the US Treasury, the Federal Reserve, and private institutions, led by some of the world’s most prominent economists and analysts, were operating according to a new economic model, modern monetary theory (MMT), which claimed central banks could print money indefinitely in response to market conditions. MMT argues that when a country controls its currency, it doesn’t have to rely on taxation and spending because it can print more money as a counterbalance, which was a fool’s errand, or a poorly validated economic thesis when considered retrospectively.

In addition, economists and central bankers believed that if the free market was allowed to run its course, it would self-correct without central bank intervention, a theory called laissez-faire economics.

In the absence of direct or indirect intervention from central banks, the production of goods and services will self-correct according to the laws of supply and demand. This theory was widely endorsed by Allan Greenspan, the US Treasury Secretary from 1987 to 1997, and held many prominent positions in the private sector, academia, and government until 2008.

🛡️ Who were the CypherPunks?

Cryptography was theorized to be used to create purely digital assets in the 80s by an alliance of cryptographers and computer scientists called cypherpunks. Incorruptible by design, and free from devaluation and debasement.

Let’s for a second review the adage, “Absolute power corrupts absolutely”, to reaffirm a point: When a man is given the freedom of choice, they will almost invariably act upon their own self-interest. This assumption demonstrates many of the theories pushed by the early proponents of cryptography, who believed that there was no way to liberate civilization from the control of the government, by way of privacy, and monetary and fiscal control, without cryptography, backed by strong mathematics.

The group also pushed other privacy-enhancing technologies (PET) to solve a few core objectives: Data should remain private and confidential for end users. Institutions managing data were responsible for two core themes, which basically state that information should be kept confidential, and that data management should prioritize data protection as the base case to ensure privacy and safety for the end user. You can find more information about PETs in this post that I used for my research.

In much of their early work, they focused on creating a secure online environment for the world in perpetuity using cryptography. It is possible to view these early principles and the work of this group as the first large-scale efforts toward Bitcoin’s creation. It has been suggested that Satoshi Nakamoto could be one of the members of this group, or that this group could be Satoshi Nakamoto himself.

In terms of the sheer engineering and networking excellence of the Bitcoin whitepaper, it’s highly likely that it was written and developed by a group of highly skilled programmers and mathematicians, but that’s beside the point for this post and warrants its own article…

The main takeaway from this section of the post is cryptography was now considered the only method to prevent currency devaluation and debasement, backed by strong mathematics.

Another key takeaway from this section is about human nature in a capitalist society. As we reviewed earlier in this section, the intrinsic nature of a capitalist, free-market society is that when a man is given unbreakable rules, they will be broken, and power will always and invariably be used for personal gain. For me, this more behavioral or societal call-out highlights the base case for regulation in the web3 space. For the sake of blockchain and web3, guide rails must exist, so that investors and speculators are able to protect each participant from harm within the network, or market.

👾 About David Chaum and DigiCash

In 1983, David Chaum created eCash, the first cryptocurrency, allowing anonymous and secure transactions between two users. After eCash, Chaum started DigiCash to bring the first cryptographic-money system to the mass market.

In 1998, DigiCash went bankrupt, but many of the core principles employed in the design of DigiCash and eCash laid the foundation for BitCoin and the subsequent layer-1 and layer-2 networks, such as Ethereum, Near, and Solana, that went live in succession to Bitcoin.

Satoshi Nakamoto and David Chaum were two of the original members of the cypherpunk movement and have both been credited with creating the foundation of what would eventually become Bitcoin. They both developed mechanisms to maintain privacy in digital payments and worked to make the process easier for people to safely transact online.

🔓 History of Bitcoin

Satoshi Nakamoto, a mysterious individual (or group), published the Bitcoin whitepaper in 2008. This date marks the beginning of the digital tokenized era, a new era in financial technology and monetary systems; Bitcoin was published in response to the worldwide economic meltdown of 2008 and widespread distrust of the existing banking system as a result of these events. The Bitcoin whitepaper was incorruptible by design, and it was not governed by traditional institutions that almost led us to the destruction of private, public, and government entities in 2008.

As an open-source blockchain network, Bitcoin is not owned by any one person or organization and has thousands of contributors. Bitcoin uses peer-to-peer technology and cryptography to secure its network. Blockchain smart contracts need to include an accounting system to ensure ownership or access rights (permissions) which we’ll unpack in a bit.

Bitcoin was originally used as a means of transferring value between two parties (bidirectional payment), and as an investment vehicle that fluctuates in value according to supply and demand. The 21 million supply limit makes Bitcoin deflationary by design. More than 19 million coins have already been minted to date. The block reward was reduced to 6.25 BTC per block from 12.25 BTC per block in May 2016.

The use cases have expanded to cover a wider array of blockchain sub-industries, including defi, gameFi, and non-fungible tokens, since its initial use cases for the bitcoin network, and before its subsequent generation-2 networks, namely Ethereum.

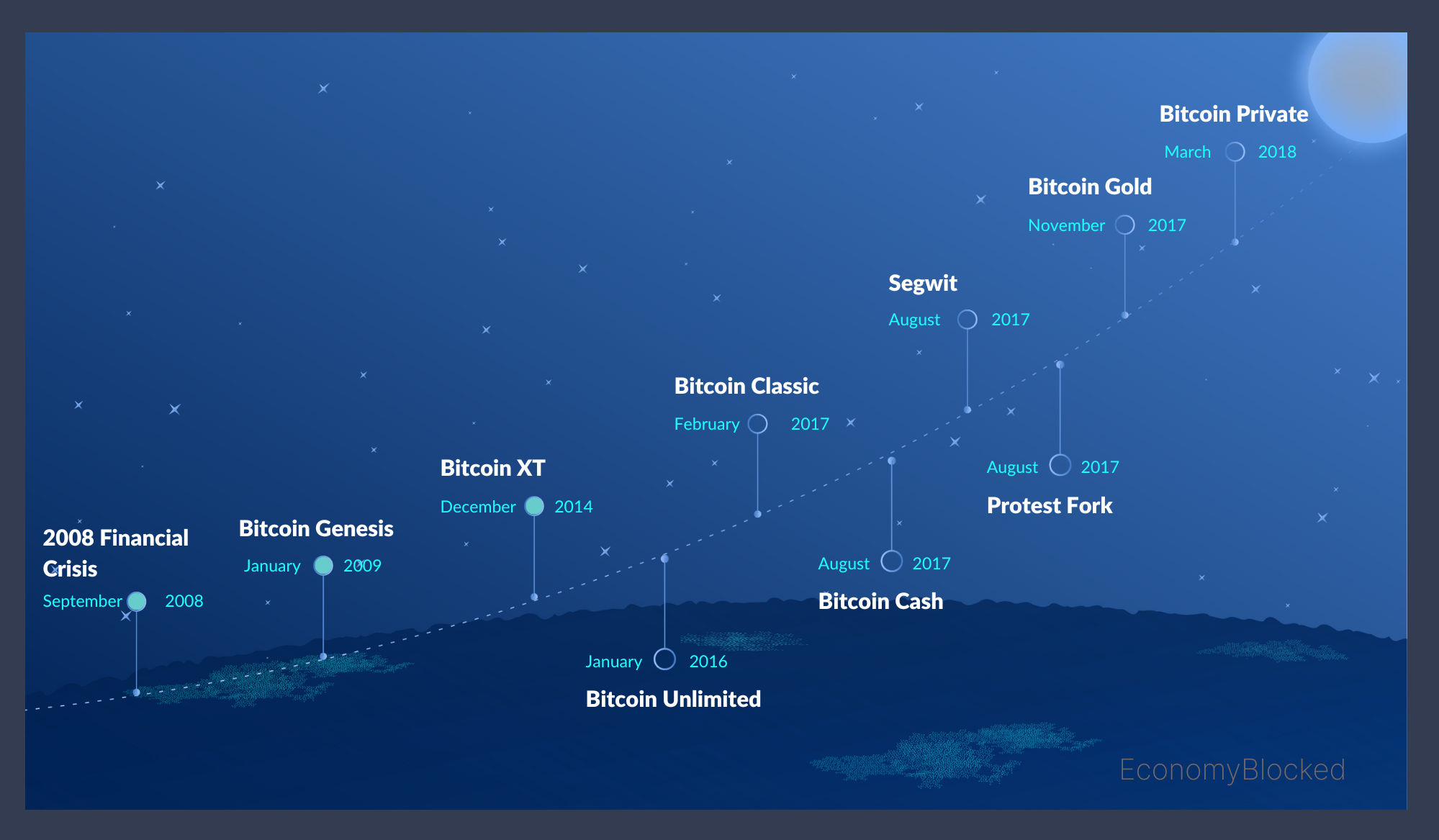

₿ Bitcoin Hard-forks Timeline (2008- 2018)

🔐 Bitcoin Smart Contract Development & Triple Entry Accounting

Bitcoin’s network and smart contracts are written in C++, which is known for its durability and security. There are also smart contract implementations in Solidity, Java, javascript, and Python, among others. To validate transactions and add new blocks to the blockchain, Bitcoin uses a proof-of-work consensus algorithm.

A triple entry style of accounting is used in Bitcoin. For every transaction that is broadcasted to the network, there are three ledgers: the sender’s, the receiver’s, and the miner’s. The miner’s ledger is a list of all the transactions that the miner has processed. The sender’s ledger is a list of all the transactions that the sender has sent to the receiver. The receiver’s ledger is a list of all the transactions that the receiver has received from the sender. This triple-entry style of accounting is similar to the double-entry bookkeeping system used in traditional finance. The benefit of this system is that it provides a clear and transparent view of all the transactions that have occurred in the network.

👨💼 Michael Saylor and The Bitcoin Standard

My approach to evaluating an industry or new technology is to look to the thought leaders in the given domain or field. Michael Saylor is a leading proponent of Bitcoin, and a thought leader in economics, business ,and technology. His CV demonstrates his abilities and skills as an MIT graduate and valedictorian of his high school. Over the last few years, Saylor has been on the media cycle presenting his views on topics well beyond Bitcoin (BTC), including macroeconomics/ microeconomics, technology, business. With his truly venerable oratory skills, he makes an exceptional case for bitcoin as a store of value over traditional fiat-based currencies. Saylor published a whitepaper in which he describes the evolution of money and the need for a new monetary system.

Saylor founded and is the CEO of MicroStrategy, a software-based business intelligence company with a commitment to Bitcoin. On August 11th, 2020, MicroStrategy acquired 250 million USD of Bitcoin to be held on their balance sheet. As a result, it became the first publicly traded company to hold Bitcoin on its balance sheet, a major step forward for the industry.

Saylor is a vocal advocate for Bitcoin adoption, and often cites the potential for Bitcoin to become the reserve currency of the internet per se. A way to store your own money without an intermediary and speaks about the importance of decentralization and the immutability of the Bitcoin network.

💭 Michael Saylor Bitcoin quotes…

☑️ “Bitcoin is digital gold, it’s a place to store your value and a hedge against inflation.”

☑️ “The world needs a non-sovereign store of value that is not controlled by any nation-state and that has no borders.”

☑️ “Move assets into cyberspace so that they can not be debased or destroyed.”

⚔️ Bitcoin Ecosystem Growth and Development

It has been remarkable to see the Bitcoin ecosystem grow over the last few years - there are now hundreds of exchanges, wallets, and other services that allow users to trade, buy, sell, and store, etc, (BTC) Bitcoin – Additionally, the development of new technologies such as the Lightning Network has made Bitcoin more secure and efficient for more use cases beyond peer-to-peer transactions.

🔲 Web5.0

Another very vocal proponent of Bitcoin is Jack Dorsey, the CEO of Block (SQ), formerly known as Square, as well as TBD, Block’s decentralized ledger technology (DLT) team . During Decrypt 2022, Dorsey unveiled TBD’s plans for web5, which echoes many of the original teachings of the cypherpunk movement: privacy, decentralization, identity protection, and data storage, etc.

On the web today, identity and personal data have become the property of third parties. One of the key value propositions of Web5 and TBD has been its ongoing commitment to Bitcoin (BTC) as a store of value for the web5 network itself. Web5 is a combination of web2 and web3 with the overall mission to build the next interaction of the internet.

Web5 has a number of key value propositions, including: Decentralized identity and storage, fewer entry barriers than many web3 networks and protocols, and is designed from the beginning for the mass market, with the aim of solving the massive adoption problem that web3 has been trying to solve for years now. In addition, it was designed with developer experience (DX) in mind.

⚡ The Lightning Network

A number of key pain points have been identified with both the gen 1 and gen 2 blockchains, i.e. Bitcoin (BTC) and Ethereum (ETH), by both customers and businesses. Several of these pain points were addressed with the lighting network.

Among the core value propositions of the Lightning network are instant payments measured in milliseconds, scalability, allowing millions of transactions per second across the network, while capacity “blows away legacy payment rails by many orders of magnitude”. Additionally, Lightning’s low cost removes the high barrier to entry for incumbents and allows for the identification of new use cases for blockchain, such as micropayments.

In addition, developing new technologies such as side chains could improve Bitcoin’s interoperability, scalability, security, and privacy limitations, which has lead to some users of the BTC network to focus on other protocols, such as ETH.

One of the other notable use cases for BTC’s lightning network is decentralized finance (DeFi) applications, which may make it easier to use Bitcoin for real-world transactions and replace some traditional financial instruments in the future.

💵 Bitcoin Long-Term Outlook

Due to the current bear market conditions and subsequent insolvencies within web3, the long-term outlook for Bitcoin is highly uncertain. Some analysts believe that Bitcoin (BTC) could continue to rise in value in 2023, while others are less optimistic. As we’ve pointed out throughout this post, the cryptocurrency market can be highly volatile, and prices can change quickly.

Thus, when investing in Bitcoin, it’s important to do your own analysis/research, and due diligence. This post is intended to provide a technology-first perspective on Bitcoin, not necessarily an investment-first perspective. However, since we want to satisfy every possible user group who is interested in reading/learning about Bitcoin, let’s briefly review the current and long-term price outlook for Bitcoin (BTC), followed by a technical buy/sell signal for (XBT).

💹 Bitcoin: current price and All-time-high

According to many analysts, Bitcoin could reach $100,000 in 2023. Based on recent economic figures, such as inflation figures, jobless claims, and other lagging indicators, it’s more likely that the price won’t reach new highs until 2024 at least.

In consonance with this assumption, the asset will not increase much in value until the next major bull market. At this point, it’s highly likely the asset will reach new highs and attract the attention of institutional investors who are developing the infrastructure to support digital assets. Furthermore, new regulations and laws will make it possible for pension funds and large banks, who have access to the most capital, to acquire Bitcoin to be either held on their balance sheets or used to offer Bitcoin-related investment products to their clients.

₿ As of 3-1-2023, Bitcoin (BTC) is trading at ~$23,791.20 USD. This represents a year-to-date increase of 43.28%, but a decline of 46.42% over the last 12-month period, with a market cap of $456 – At the peak of the last business cycle, Bitcoin reached an all-time high of $67,567 on Nov 8, 2021. The market cap of bitcoin at the time was $1.291T USD, with 18.9 million bitcoins in circulation.

₿ XBT - Technical Analysis (Buy/Sell Signal via TradingView)

🌐🎖️ Final Thoughts

As I have pointed out time and time again, the value of decentralized ledger technologies (DLT) and token-based economies are unequivocal, though there is a great deal of uncertainty regarding their future, as a result of the volatility and uncertainty that comes with crypto and blockchain, and much of the negative attention the industry has received from the media. I understand the counterpoint to Bitcoin by its detractors, but overall, I personally believe it’s a superior currency, simply from the standpoint that its true value can only be determined by market forces, and can not be debased intentionally based on political objectives.

The main goal of this piece is to gain a deeper understanding of the reasoning behind the creation of Bitcoin, allowing for a more comprehensive perspective on its future. Additionally, we unpacked the 2008 financial crisis, including MBS and CDO derivatives, and modern monetary theory (MMT), thereby providing a complete picture of the market forces and consumer behaviors that eventually led to the housing crisis due to sub-prime toxic debt.

Once we developed a firm understanding of the catalyst, we moved on to explore the history of Bitcoin, including the fundamental work of groups such as the Cypherpunks and David Chaum. Once our historical foundation was set, we reviewed some of the mechanics of bitcoin development. Next, we reviewed Michael Saylor, CEO of Microstrategy - Our final bucket of information includes Bitcoin’s ecosystem growth, price analysis, as well as a technical buy/sell signal.

👾 More Recent-Posts

-

Macro & Geopolotics Report: 2023 Business Trends Report

In this post, we discuss macroeconomics, as well as geopolitics as part of the 2023 Business Trends Report 🌍

-

💲NEAR Protocol: Overview and Price Prediction

In this article, we will be conducting an extensive analysis of the 💲NEAR protocol, which is the platform I have the most experience building dApps on, as a Product Manager in web3

-

8 Healthcare Industry Trends and Innovations

In this post, we will be reviewing 8 business trends for the healthcare industry, including each of it's sub-industries, such as MedTech🔬

-

Cardano(ADA) Overview and Price Prediction

As a part of this post, we'll be reviewing what Cardano (ADA) is, its benefits, Tokenomics, a price prediction model, and the future of its fledgling ecosystem 💱

-

Ruby on Rails and The Future Of MVC

Discover the amazing potential of Ruby on Rails! Learn about its history and design philosophy, why it's the perfect choice for web development, and how to get started with the framework ♦️

-

Artificial Intelligence: Business Trends Report

Large language and generative models are reaching a point of emotional realness that they can no longer be distinguished from humans 🚀

-

2023 Geopolitics Report

A guide to help both businesses and product managers use geopolitics as a strategic advantage in 2023

-

Post-Industrial Digital Banking

Explore the post-industrial era of digital banking. Deployment-based market research, post-industrial hypothesis validation,opportunities,and more 📲

-

How 👾 (AI) Will Transform Product Management

In this post, we will unpack how (AI) will transform aspects of product management, as well as it's impact across cross-functinoal teams 🎖️

-

2023 Transportation Industry Trends 🚊

In this post, we will be covering 2023 Transportation Industry Trends, including market research, business strategy, and more... 🚉

-

Energy Sector Forecast 2023 ⚡

The 2023 Business Trends Report covers sector-based projections, major innovations, market dynamics, opportunities, and technologies by sector or industry - this post covers both traditional and renewable energy markets 📈

-

To-Blog Or Not-To Blog❓ | 2023 Blog Launch Helper |

This post is designed to help you or your team launch and optimize a successful blog by examining why businesses blog, providing a blog business plan guide, exploring SEO and analytics tools, and an overview of blogging platforms and frameworks

-

Make the web fast again | What is a CDN❓| How do CDNs work❓

In this post, we review what a CDN is, how they work, the business of cdns, as well as some of the best options to consider when choosing a cdn

-

We're In Way Over Our Heads | Going Headless (CMS)

Content is king! In this post we review Headless-CMS, content management systems; How they work, an overview of JAMstack, some of the best options, etc, will be discuessed

-

Building Static Websites In An Un-Static-World (SSGs)

In this post we'll be reviewing (SSGs) static site generators, reviewing the tech as a means of providing value to your next project or business during times of uncertainty– The advantages, how they work, and evaluating frameworks, including Jekyll, Hugo, and Gatsby. JS, etc 🛠

-

How (AI) is changing the way we work

In this post, we'll explore two use cases for (AI) ⚔️ (AI) Writing and Text-To-Image (Generative-AI) – How they work, as well as their current and future, use cases for the workplace, as well as available tools and services

-

Industrial Revolutions

Part-1 (1-2 IR) This is the first post of the Industrial Revolution series, covering the 1st and 2nd Industrial Revolutions, major tech innovations and advancements during each period

-

Industrial Revolutions

Part-2 (3-4 IR) This is the second and final post of the Industrial Revolutions series, covering the 3rd and 4th Industrial Revolutions. Focusing on the tech and innovations during this period

-

Tokenomics

Ledgers and Accounting represent two foundational aspects of tokenomics and token-engineering, this is the first of many post where I will be covering tokenomics, focusing on presenting my research and aspects of system design

-

Fintech Deep-dive

How the tech industry is changing finance: This post outlines the history of financial technology (FinTech) and major innovations, as well as companies at the forefront of this sector

-

Web 3 Systemic Issues Report

In this post I review some of the most systemic-issues that I have identifed after contributing to a few web3 startups in varying levels of involvement – please take what is stated as speculative conjecture, nothing more 🙏